What do you need to know before you get a GAP Insurance quote? Here are our Top 10 questions you may want to ask first. We base these on our 10 years of experience online and have serviced hundreds of thousands of policies for customers in that time.

The most obvious question we are asked is 'What is GAP Insurance?', so that seems as good a place to start as any. Whilst there are a number of types of GAP cover ('GAP' is short for Guaranteed Asset Protection if you were wondering), but the basis of them all is the same.

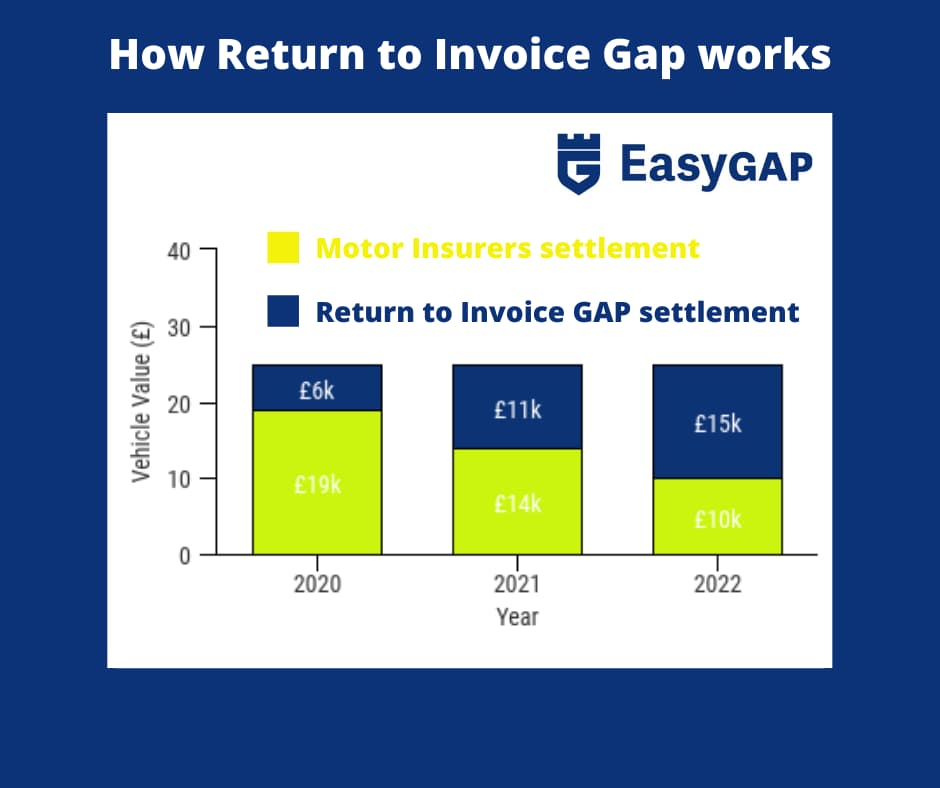

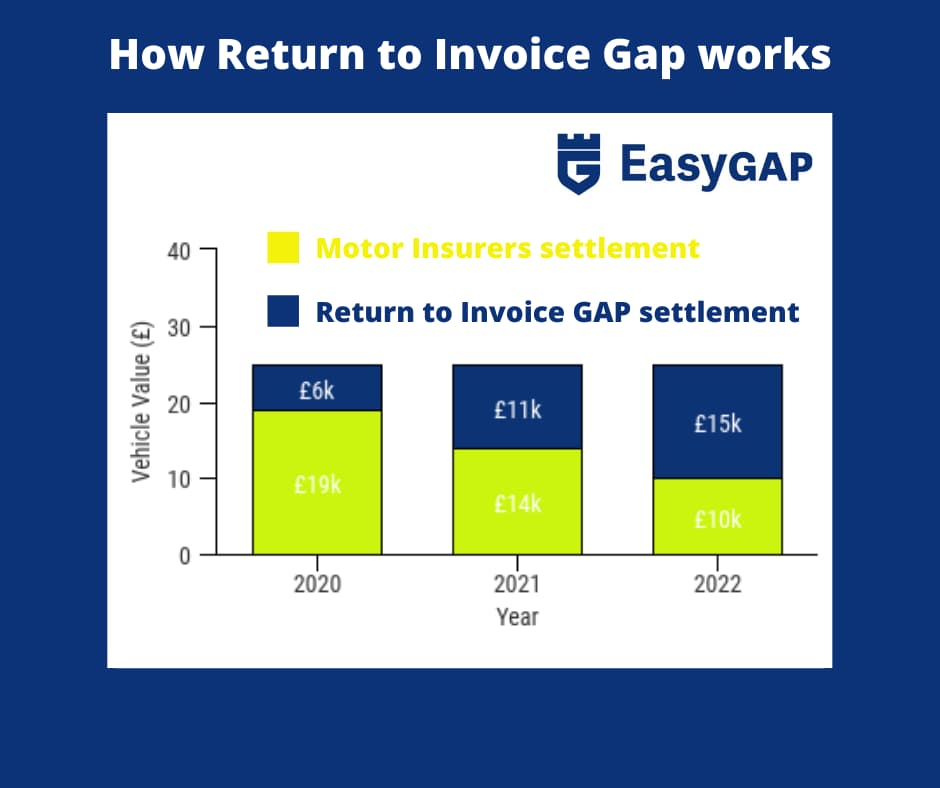

The vehicle you buy will lose value over time. The longer you have it, the more it will lose in value.

If this vehicle is involved in an accident, theft, flood, etc then you are in the hands of your motor insurer. The motor insurer may decide to repair or replace the vehicle for you. If so, you have not suffered any financial loss, so you have no GAP claim to make.

But, the motor insurer may decide that the vehicle is not economically viable to repair. The vehicle may then be declared a 'total loss'. Then your motor insurer may only pay you with the market value of the vehicle at that time.

The 'market value' is what it would cost to replace the vehicle with the same model and mileage at the time you claim.

As this 'market value' settlement will be less than the price you originally paid for the vehicle. It may also be less than you may owe on a finance agreement also. If so, you have suffered a financial loss.

GAP Insurance can cover an element of financial loss. Which element you wish to protect determines the type of GAP Insurance you may buy.

In essence, you are looking to plug the insurance GAP that your motor insurance may leave.

That brings us nicely to....................

There is no 'one size fits all' answer for GAP Insurance in 2020. The days of a simple three year Return to Invoice being the only option has long since gone. You may find many GAP Insurance products that could be available for you. Which one would suit you, in particular, takes a bit more thought.

So the next question is simply......Which is the best Gap Insurance?

Here we provide a simple GAP Insurance comparison for the different types available.

This a style of GAP Insurance specific to lease agreements where you have no option to own the vehicle written into the agreement. These agreements are a fixed-term rental, with an advanced payment equal to 3, 6 or 9 monthly rentals at the start, in many cases.

These ‘advanced rental’ payments can be substantial. Many Contract Hire and Lease GAP products allow you to protect these payments with a ‘deposit protection’ option. This means you can claim back a selected amount of your advanced rental, giving you this money to use as a deposit on your next vehicle.

Combined Return to Invoice GAP - covers the difference between the motor insurers settlement and the original sale price paid for the vehicle, or the outstanding finance settlement, if that is higher.

Combined Vehicle Replacement GAP- covers the difference between the motor insurers settlement and the cost of replacing the vehicle with the same model you first purchased.

For example, if you bought a brand new Mini Cooper 1.6 D then the cost of another brand new Mini Cooper 1.6 D at the time you make the claim. This price may well be higher than the invoice price you first paid.

Please note, Easy Gap does not currently provide Vehicle Replacement Gap Insurance. Please try our sister websites at either (click the names to take a look) Totallossgap.co.uk or Shortfall.co.uk.

Combined Invoice and Replacement GAP - covers the difference between the motor insurers settlement and the higher of:

The advantage of this type of GAP Insurance is that it brings Return to Invoice GAP and Vehicle Replacement GAP into one ‘hybrid’ policy. By doing so it guarantees the best outcome between invoice and replacement settlements, in the event of a claim.

Put simply, if at the time you claim the future replacement cost of the vehicle is higher than the invoice price you paid then it is the replacement cost that is covered. Conversely, if the original invoice price is higher than the replacement cost then it is the original price you paid that is covered.

This policy really is the best of all worlds.

Agreed Value / Return to Value GAP- covers the difference between the motor insurers' settlement and the value for the vehicle at the time you buy the policy.

The word 'combined', or 'combi', or 'plus' is often added to the name of a Gap Insurance product. It normally means that the policy can cover one of at least two events.

For example, a 'Combined' Return to Invoice can cover the difference between the motor insurers settlement and either the outstanding finance settlement or the original invoice price paid, whichever is the higher at the time you make the claim.

Combined Invoice and Replacement GAP can cover the highest of three events; the outstanding finance settlement, the original invoice price paid, or the future replacement cost of the vehicle.

The 'claim limit' is simply the highest amount that your GAP Insurance policy will pay, in addition to your motor insurers settlement, in the event of a claim.

For example, you buy a car for £10,000 and you have a three-year Combined Return to Invoice policy with a £5,000 claim limit. This means you have up to £5,000 to cover between your motor insurers' settlement and the original invoice price you paid. You can see that choosing a claim limit is important, and you want to be sure that you have sufficient to cover any claim during the policy term.

If you have a more expensive vehicle, or you want longer cover, then the 'gap' you need your claim limit to cover will be bigger.

Picking a claim limit is not always easy.

Different providers have different approaches to claim limit options. For example, at Easy Gap our RTI product claim limit is the full invoice price you have paid for the vehicle, on vehicles up to £25,000 purchase price, and a maximum of £25,000 on all vehicle purchase prices above £25,000.

At our sister website at Total Loss Gap, the Combined Invoice and Replacement GAP has no upper claim limit at all.

When it comes to Contract Hire & Lease products on Easy Gap, again there are no upper claim limits on monthly rentals up to £500 a month. Monthly rentals between £500 and £750 a month come with a maximum of £25,000 claim limits.

All GAP products can differ in claim limit options. It is important to check because if your claim limit ends up being too low, you could find yourself with more to pay even with a GAP Insurance policy in place.

This can differ depending on the type of GAP Insurance you want. If in doubt then you should use as close to the net invoice price you have originally paid for the vehicle, certainly with Combined Return to Invoice or Combined Vehicle Replacement.

How do you get this figure? Well, it should be on your invoice and should include any factory extras, cash deposit, part exchange allowance. The figure should not be the list price of the vehicle if a discount has been applied, or include any interest from the finance agreement.

For Contract Hire agreements you may not have a purchase invoice for the vehicle. In that case, the P11d value would be perfect, if not the list price for the vehicle from the manufacturer (these should be very similar, if not identical). NB With Easy GAP we do not require the P11d value for the quote, only the monthly rental amount you are paying.

For

Agreed Value then you can get the Glass' Guide value for the vehicle directly at

Glass.co.uk.

This is simply because this figure is probably completely irrelevant for the claim, and you may even end up paying more premium than you need to.

Let us explain. If you take a Combined Return to Invoice Gap, and for a brand new vehicle the list price was £26,000 and you ended up paying £23,000 (after some expert haggling), then the net invoice price you paid is always £23,000. This is the maximum you will receive from this type of policy.

If you had taken a Combined Vehicle Replacement Gap on the same vehicle, remember it is the cost of a brand new replacement at the time you make the claim. Again the £26,000 list price when you bought the vehicle is completely irrelevant, as the replacement cost at the time you claim could well be a higher price again.

At Easy Gap we ask you to use the net invoice price you paid, for our Combined Return to Invoice GAP.

We will always ask for a copy of the sales invoice in the event of a claim, so as long as that figure is correct then we can process your settlement accordingly. Please be aware that some providers will ask you to use the list price for the vehicle, not the price you paid. We feel this is confusing, irrelevant, and misleading and may even penalise you financially. At Easy Gap we like to keep it, well easy!

This happens more than you think!

This can differ with providers in the market, and there can be quite a difference between the products in the motor dealer and online providers like Easy Gap.

Most GAP products will allow you to cancel the policy, and apply for a 'pro-rata' refund for the time left on the policy. This is commonplace with both motor dealer and online products.

However, one difference you may find is that the motor dealer products will not allow you the option to transfer your cover to another vehicle. This can be extremely convenient when you part exchange your vehicle for a new one. The options at Easy Gap (and many other independents) include either to transfer the balance of the current policy or if you wanted longer for the new vehicle, you can have the credit left on the old policy against the cost of your new Gap cover.

If you were wondering, some motor insurers will replace your vehicle in the first year (some extend to two) with another new one, if you meet the criteria they ask on a new car purchase. Do you need GAP Insurance at this time? Do you even need it at all?

This may save you money, but you have to check some facts first!

This is a great question and one that we are asked time and time again. We also see it often on internet forums, with a wide range of opinions given in response.

However, you need to consider the following points

The key here is to check the terms of your motor insurance, and ensure that the terms they offer for a replacement vehicle are something you are happy with. If you feel they are not, then it may be wise to take a GAP Insurance policy from ‘day 1’ of your ownership, to be sure. This can act as a fall-back if your motor insurer does not replace the vehicle, and only provides a ‘market value’ settlement instead.

However, if you are happy with the motor insurers terms for the first year, then we have a solution for you........defer the start date!

What is 'deferred' Gap Insurance?

If you have 'new for old' replacement cover with your motor insurer in that first year (quite common with a new vehicle, so a good idea to check), and you are happy with the terms, then you can simply defer the start date of the GAP Insurance until the replacement terms run out.

This usually means that you set the start date of the Gap Insurance for the anniversary of the vehicle registration with the DVLA, and means that your Gap cover 'kicks in' as your motor insurers terms for a replacement come to an end.

There are some key things you need to remember though

-

Even with a deferred GAP policy, you must still buy the cover within the set period from your vehicle purchase. We do not currently cover ‘deferred’ start dates on GAP Insurance on Easy Gap, but our sister website at Total Loss Gap does. There you must buy the policy within 365 days of buying the vehicle. You must also be able to show, in the event of a claim, that you had ‘new for old’ replacement cover for the first year on your vehicle.

Deferred GAP products are quite rare in 2020. Many consumers like to know they have a GAP Insurance policy to rely on if the motor insurer does not replace the vehicle.

For example, even if you had new car replacement with your motor insurer, and you had to make a claim during the Coronavirus ‘lockdown’, with manufacturers not building vehicles at factory and motor dealers not open to supply them, how could your motor insurer get hold of a replacement vehicle for you? There is every chance they would be forced to settle on a market value basis instead. If you have no GAP cover to fall back on then you could lose out substantially.

Like all insurance, GAP Insurance will have terms and conditions. There will be times where you are ineligible to make a claim.

Some common examples of where GAP Insurance may not settle include:

-

Where the main motor insurer does not payout. This could be where the driver of the vehicle has been negligent, drink driving, or generally breaking the law. It could also be where you have lent the car to someone who is driving it on their own insurance on a 3rd party basis. If they ‘write off’ the vehicle then your main motor insurer will not pay out the market value to you as you are not insured for that.

-

If the vehicle does not belong to you. If you take out a GAP Insurance policy then you must have an ‘insurable risk’ on the vehicle. That means you stand to lose out financially if the vehicle is written off. This can happen if you own the vehicle outright, have finance on it, or have a lease in your name on the vehicle. If none of these apply then you have no loss to claim if it is written off (for example, the sales invoice for the vehicle is not in your name).

If we got a pound for every time we are asked this question then we would be able to give you your Gap Insurance for free!!! Well, maybe not quite! The age-old debate on Gap Insurance cost.........

The difference between the premiums charged by motor dealers, and those from online brands like Easy Gap, can be eye-watering. The savings can lead some to question whether you are even looking at the same sort of insurance.

We received the following feedback recently, and this is typical of what we hear time and time again.

"I got an on-line quote then called to speak with someone just to make sure it was exactly what I wanted/needed. The guy was really helpful on the phone and the price was amazing. £299 from the dealer where I was getting the bike, £99 from you! It's a no brainer."

".....£200 cheaper than the identical policy offered by the dealer"

"Dealership offered my 3 years cover for £299 and I have got this for £99"

Same sentiments over and over again, but how is this possible that the premiums are so different?

Insurance Premium Tax - When you buy a GAP Insurance policy from your motor dealer, then the rate of Insurance Premium Tax you pay is the highest rate of 20%. When you buy independently, it is the standard rate of insurance premium tax, which is traditionally lower (currently 12%).

Supply chain - When you buy GAP Insurance from the motor dealer then because they provide a low number of policies as a business they will not be able to get a deal directly with an insurance distributor, or at least not a very good one. This means that they may need to go through a manufacturers finance company, the head office of the dealer group or some other kind of collective that an insurer will deal with. This adds further 'cogs to the wheel' and therefore can increase costs quite significantly.

Stand alone brands, like Easy Gap, have underwriting deals directly with insurers and distributors, based on the volume of business we can provide. This lowers costs significantly.

Commission structure - Remember when you buy a policy from Easy Gap we do make a profit. When you consider that you can buy a policy from us at around £130 that the dealer may offer an equivalent for £400, then you can imagine what commission payments are made per sale to employees of the dealership. A £400 policy may have a commission for the salesman, the business manager and even the sales manager within the premium you pay. Remember you could even have the price of the GAP Insurance added to your finance, meaning more interest and even more commission for the dealer.

We hope our rundown of the commonly asked questions on GAP Insurance helps you. Remember if there are any more we can help you with, just give us a call, or email us at [email protected].