Call Monday-Friday 9am - 6pm Closed Saturday & Sunday

Please select some policies.

If your new car, LCV, motorbike or motorhome is written off - ( Return to Invoice ) RTI GAP Insurance will pay the difference between your motor insurance company's market value settlement and the higher of either,

In all cases, we would not supply a replacement vehicle; any claim payout would be a cash settlement.

Combined Return to invoice (RTI GAP insurance) is an easy level of gap insurance to understand, even though it may be called many different names.

We say that this is a simple level of cover because when you buy your vehicle, you will be given an invoice, so you will know exactly how much you are protecting in advance.

To buy Return to Invoice GAP Insurance from EasyGAP, you must fit specific criteria, including:

* Market Value prices were taken from Glass's Guide dealer Retail in August 2024. Without any form of return to invoice cover and without using savings or adding extra financial commitments, this would be the only amount you would have to clear any outstanding finance or find a replacement vehicle. Prices include the cost of delivery and first registration fees but exclude the cost of the Road fund licence, as this can be claimed back from the DVLA. We would never provide a replacement vehicle; instead, you are given the funds to spend as appropriate.

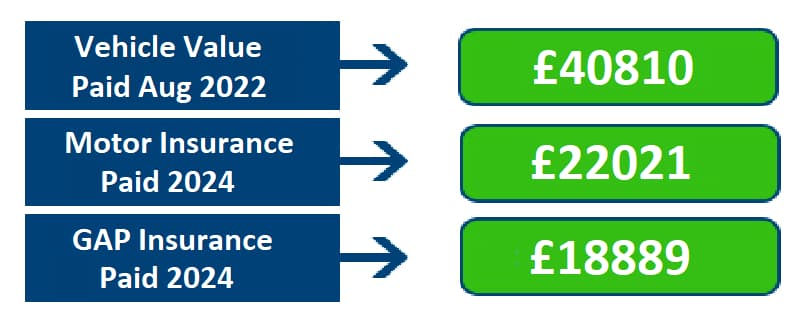

Real-life GAP Insurance claims in 2024

With our Easy Gap RTI policy, there is no charge for administration updates such as address updates or adding private number plates.

Many vehicle purchases are completed by taking out some form of finance on the vehicle. If you suffer a total loss, what happens to any outstanding finance depends on what type of agreement you had. If the finance was linked to your vehicle, for example, a Hire Purchase, PCP or anything that ties the vehicle to the finance agreement, you would usually be required to pay off the outstanding finance when the vehicle is 'written off'. Please also remember that our gap insurance is a combined policy, so if, with interest, you did owe more than the purchase price, that would be the highest amount, and therefore, that would be your settlement. ( T&C's apply )

Without any form of return to invoice or gap insurance, you would be responsible for the shortfall.

However, if you have paid for the vehicle using a personal loan, as traditionally, you are the guarantee, not the vehicle, you may not have to pay off the outstanding finance immediately. Depending on the terms and conditions of the loan, you may be able to keep the loan running and use the total settlement to buy a new car. If you do pay off the finance settlement, then the remainder of the settlement is yours.

Return to Invoice GAP insurance is suitable whether you pay cash or have the vehicle on finance. The only difference when you pay cash for your vehicle is that you have no financial settlement to settle. This means that you get the entire invoice price back in full in the event of a claim.

This is one of the most misunderstood aspects of a Return to Invoice GAP insurance policy, and we are often asked about it.

So, what does your invoice price mean?

Simply, it is the on the road - net price you have paid for the vehicle. This is before you have given a penny in part exchange or cash deposit. This can include any cash you have paid, any equity from a part exchange vehicle and any initial amount you have financed.

Any discount you have received is not included in your invoice price. Equally, any interest you will pay as part of the finance agreement or any negative equity that has come across from your part exchange vehicle has been added to your new finance agreement.

This situation is statistically possible, but it is rare.

This may happen if

Then, depending on how your finance agreement was constructed, you may owe more on your finance settlement than the invoice price paid. i.e. You have made no payments, and some interest may have been added.

If your vehicle was written off at that point, your Easy Gap insurance policy will top up the motor insurer's settlement to the finance settlement. You will walk away with no further financial liability (late payment charges and arrears are deducted). We will even pay towards your motor insurance company's excess.

Please remember that, for want of a better example, a car loan is almost like a mortgage. If you want to clear your mortgage early, you do not pay all of the interest, as you are giving your mortgage company the money back early. This is exactly the same with a car loan. If you decide to settle early, you would simply call for a settlement figure, which, unless this is towards the end of your agreement, can be significantly less.

This will depend on the purchase price paid, the length of cover you want to protect your vehicle for as well as what you are using it for. For an accurate quotation, please contact a team member or click for an automated quotation.

RTI Gap Insurance coverage may not be needed within the first year of your ownership if you have purchased a brand-new car. This is because some motor insurers offer what could be considered a form of return to invoice within the first year, which is almost a perk of buying a brand new car and insuring with them. However, we would always ask you to double-check with your motor insurer as terms and conditions may mean this new-for-old cover may not be as straightforward as you first think.

For Example

We stress that we are not trained, regulated, or authorised to comment on your car or motor insurance policy, so we would request that you contact your provider for up-to-date terms, conditions, benefits and potential pitfalls.

Policis purchased before 17th of February 2025

![]() Easy Gap Contract Hire Gap Insurance Terms

Easy Gap Contract Hire Gap Insurance Terms ![]() Easy Gap Contract Hire Gap Insurance IPID

Easy Gap Contract Hire Gap Insurance IPID

![]() Easy Gap RTI Gap insurance Terms

Easy Gap RTI Gap insurance Terms ![]() Easy Gap RTI Gap insurance IPID

Easy Gap RTI Gap insurance IPID

Policies purchased after 17th of February 2025

![]() Return to Invoice & Financial Shortfall Gap Insurance

Return to Invoice & Financial Shortfall Gap Insurance ![]() Return to Invoice & Financial Shortfall Gap Insurance IPIDs

Return to Invoice & Financial Shortfall Gap Insurance IPIDs